Visit our accounting glossary next to learn even more about consignment inventory. To ensure maximum accuracy and profitability when dealing with consignment stock, you’ll need a robust inventory management system. The NET effect of these transactions and journal entries would be summarised in the income statement reflected as below. If the entire consignment of inventory had not been sold, then only a proportion of the inventory would be transferred.

Did you learn a lot about consignment inventory in this article?

A profit or loss on the sale transaction will arise from these two entries. Navigating the complexities of consignment accounting becomes even more intricate when dealing with international transactions. Different countries have varying regulations and standards that govern consignment arrangements, making it essential for businesses to stay informed accounting for consignments and compliant. For instance, the International Financial Reporting Standards (IFRS) provide guidelines that differ from the Generally Accepted Accounting Principles (GAAP) used in the United States. Understanding these differences is crucial for multinational companies to ensure accurate financial reporting and compliance across jurisdictions.

Consignment Accounting

Instead, it is often disclosed in the financial statements’ footnotes or the inventory disclosure section. Since the consignor owns consigned inventory until it is sold, the consignee does not have to invest capital in purchasing inventory upfront. This reduction in inventory holding costs can enhance cash flow and improve the overall economic health of the business. When the goods are sold, the consignee records a sale and reduces the inventory and liability accounts.

Recording Sales

The consignee also has the option to return any unsold or damaged goods to the consigner. Other names used for consignment inventory are consignment goods or consignment sales. The accounting process for the consignment business model seems to be difficult. For example, Company A (consignor) has made an agreement with Company B (consignee).

Consignor records the consignment sales and expenses journal entry

- For example, Company A (consignor) has made an agreement with Company B (consignee).

- As such, they are not left holding obsolete stock if market conditions change or demand shifts.

- For instance, the International Financial Reporting Standards (IFRS) provide guidelines that differ from the Generally Accepted Accounting Principles (GAAP) used in the United States.

- However, the consignment inventory accounting will be different for each party.

- Instead, they maintain a memorandum account to track the items received, sold, and remaining.

The consignee pays the import duty of $200 and selling expenses of $300. Inventory items that are sold through the consignment model are often perishable, seasonal, or previously owned. However, some companies may still choose to convert inventory from one account to another to keep their records organized. Your books have to be properly taken care of to ensure that everything will run smoothly. These costs should be debited to the Inventory on Consignment account, not freight expense.

Recognizing and Reporting Gain Contingencies in Financial Statements

The balance of inventory would be inventory still held by the consignee. As the inventory has now been sold, the consignee provides an account summary to the consignor. This report is referred to as an Account Sales Report and it lists all transactions the consignee has made concerning the consignment.

To understand consignment accounting, you’ll need to know a few specific terms. When people hear the word consignment, they tend to think of consignment shops. Consignment items are brought to a place of business and sold on behalf of a person.

The consignee sells the consigned inventory on behalf of the consignor. However, the consignment inventory model poses some risks for suppliers. Consignment inventory is merchandise that’s stored by a retailing business but owned by its supplier until the items have sold.

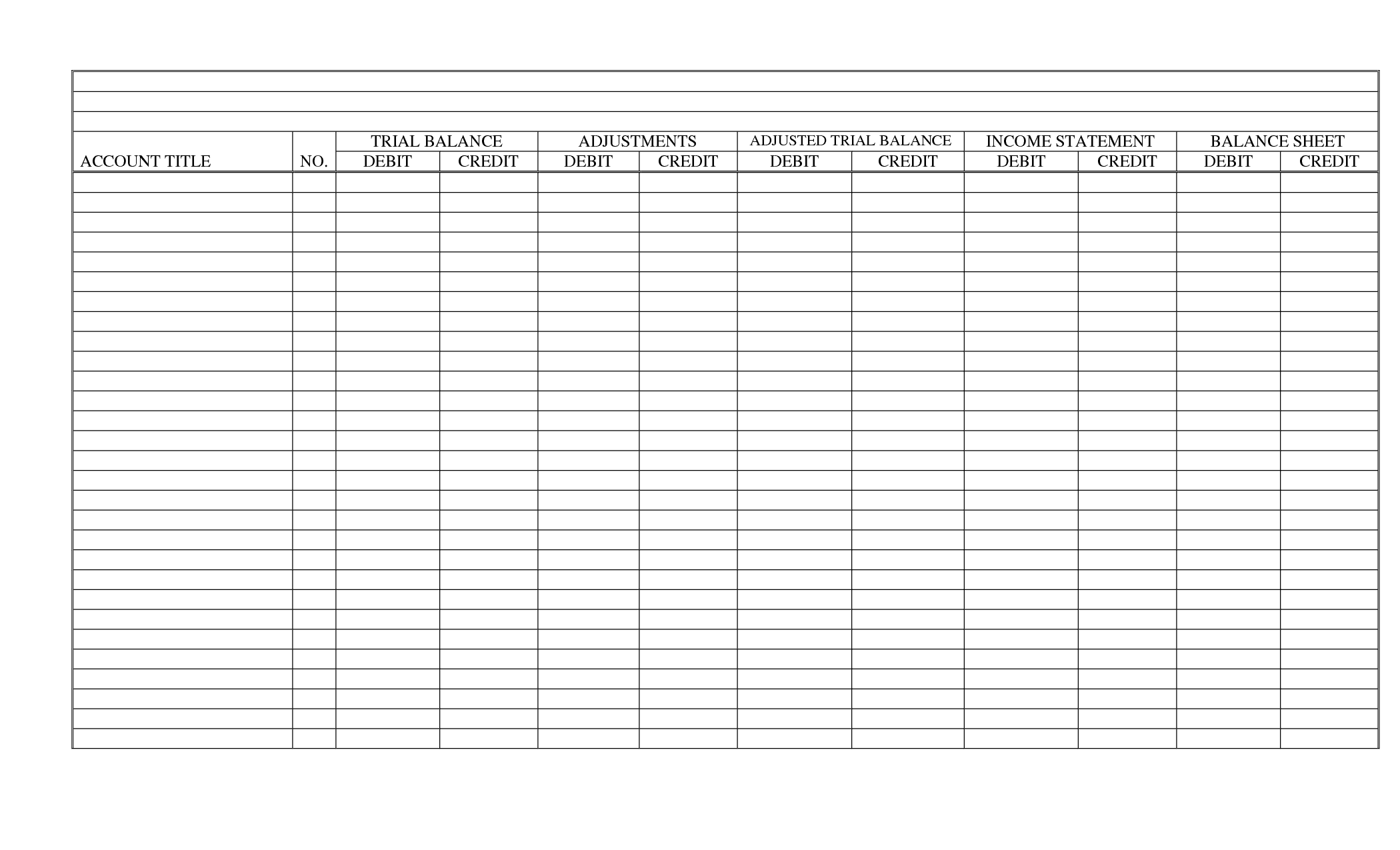

This ensures the consignor still has ownership and control over the goods. Consignment inventory accounting journal entries differ from standard sale and purchase entries. In consignment inventory accounting both the owner and the retailer must maintain their own records.

It is very hard for him to sell the books to the bookstore as the seller may doubt the sales performance of the books. They require to invest some capital on the book which may not be sold, so they may invest in other books which highly likely to be sold in a short time. Any expenses incurred by the consignee in connection with the consignment are reimbursed to him. Most often he deducts these expenses from sale proceeds along with his earned commission. Remember, a robust financial management system like Xledger can elevate your inventory management strategies and drive success in modern business operations.